Trading Platforms & Infrastructure

Build and scale your trading operations with enterprise-grade platforms, robust infrastructure, and seamless integration capabilities.

Seamless Integration with Leading Trading Platforms

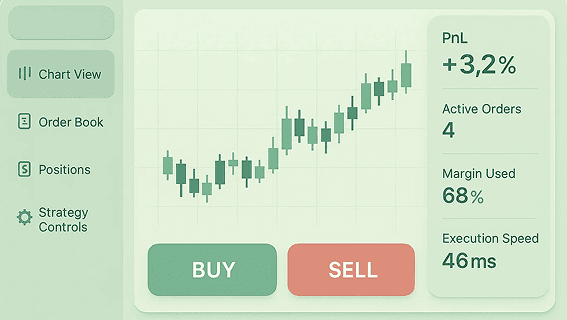

Core Trading Platform Features

Order Management

Advanced order types, smart routing, and real-time execution monitoring.

Portfolio Management

Comprehensive portfolio tracking and management tools.

Analytics Dashboard

Real-time analytics and performance monitoring tools.

Multi-Asset Trading Infrastructure

Comprehensive trading platform supporting equities, futures, options, crypto, and more with unified order management.

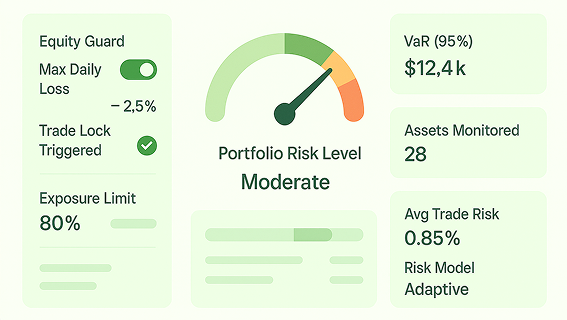

Risk Management Systems

Real-time position monitoring, exposure limits, and compliance controls for institutional-grade risk management.

Execution Analytics

Advanced execution analytics with TCA, slippage analysis, and smart order routing optimization.

Custom UI/UX

Tailored trading interfaces with customizable layouts, advanced charting, and real-time market data visualization.

API Integration

Robust API infrastructure for algorithmic trading, third-party integrations, and custom strategy deployment.

Explore More Solutions

Algorithmic Trading Systems

- Advanced execution algorithms with smart order routing and liquidity aggregation

- Real-time risk management and position monitoring systems

- Customizable strategy development and backtesting framework

Market Data Solutions

- Real-time market data feeds with low-latency processing

- Advanced analytics and visualization tools for market insights

- Custom data processing pipelines for specific market needs

Proven Track Record in

Capital Markets

Our systems power some of the most sophisticated trading operations globally

0ms

Average order latency achieved through our optimized execution engine and co-located infrastructure.

0M+

Monthly trading volume (USD) processed through our algorithmic trading systems.

0%

System reliability across all production environments, with 24/7 monitoring and support.