Trading Infrastructure

Design and implement high-performance trading infrastructure with ultra-low latency connectivity, robust security, and seamless scalability.

Seamless Integration with Leading Trading Platforms

Core Infrastructure Features

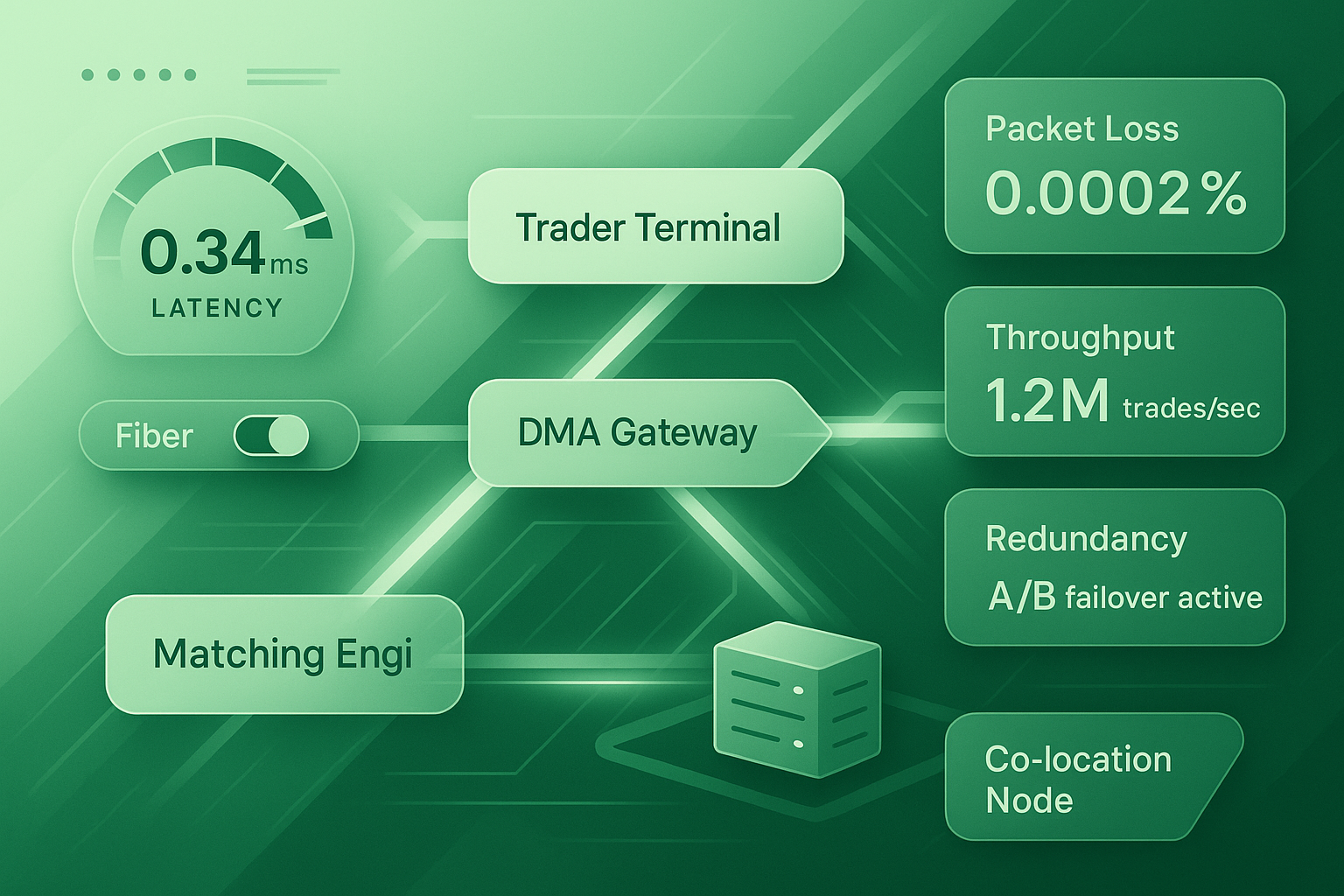

Direct Market Access

Low-latency connectivity to major exchanges and trading venues.

Network Redundancy

High-performance network with redundant connections for reliability.

Co-location

Strategic co-location services near major exchanges for optimal speed.

Market Connectivity

Direct market access and low-latency connectivity to major exchanges and trading venues worldwide.

Network Infrastructure

High-performance network infrastructure with redundant connections and minimal latency.

Co-location Services

Strategic co-location services near major exchanges for optimal execution speed.

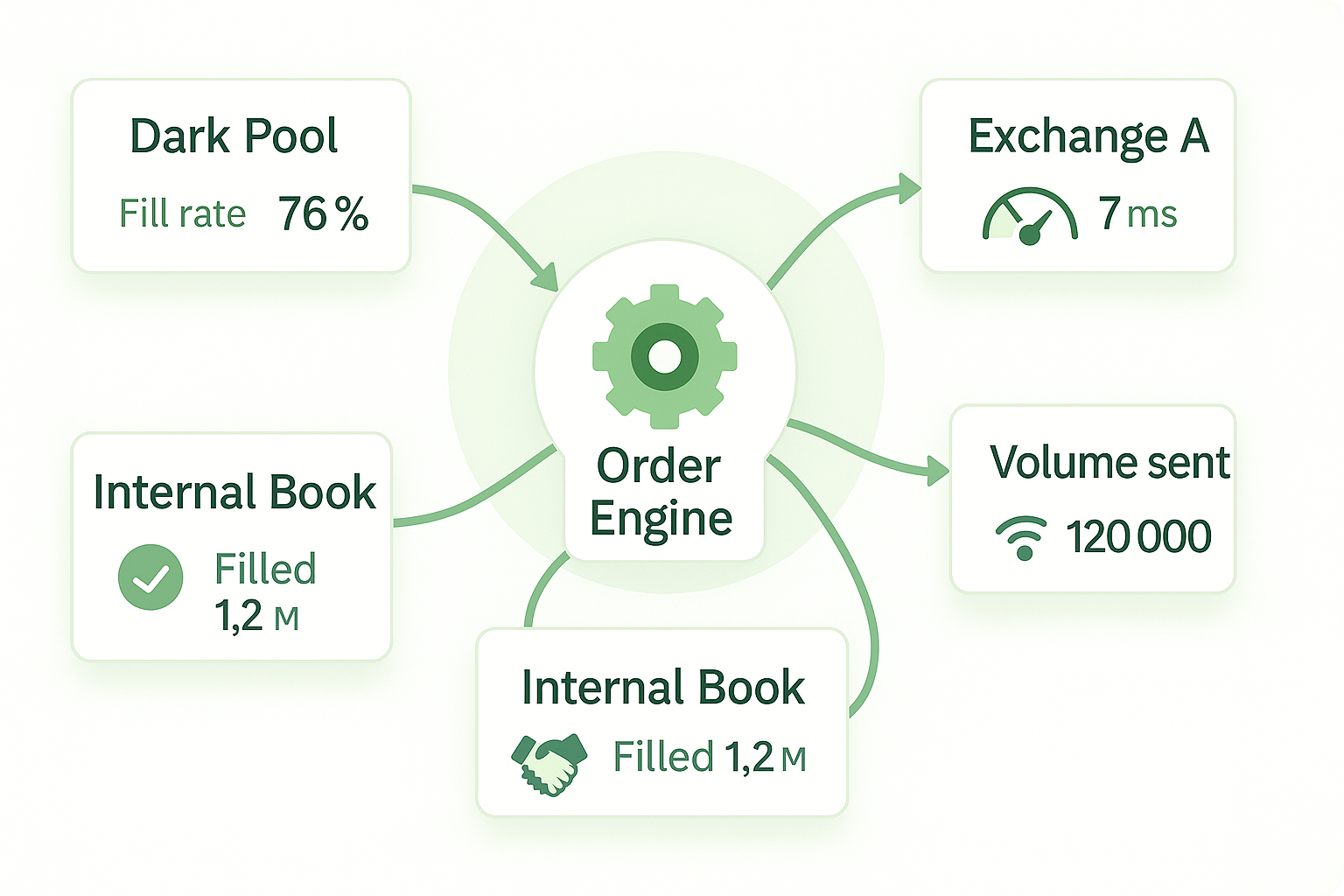

Smart Order Routing

Intelligent order routing systems for optimal execution across multiple venues.

Risk Controls

Real-time risk controls and pre-trade checks for secure order execution.

Explore More Solutions

High-Frequency Trading

- Ultra-low latency infrastructure with FPGA/ASIC acceleration

- Direct market access and co-location for optimal execution speed

- Real-time monitoring and failover for uninterrupted trading

Smart Order Routing

- Intelligent order routing with venue analysis and best execution

- Customizable routing logic for multi-asset and multi-venue trading

- Real-time performance monitoring and reporting for compliance

Proven Track Record in

Capital Markets

Our systems power some of the most sophisticated trading operations globally

0ms

Average order latency achieved through our optimized execution engine and co-located infrastructure.

0M+

Monthly trading volume (USD) processed through our algorithmic trading systems.

0%

System reliability across all production environments, with 24/7 monitoring and support.