Quantitative Research & Data Engineering

Build robust research infrastructure and data pipelines to power your quantitative trading strategies with cutting-edge technology.

Seamless Integration with Leading Trading Platforms

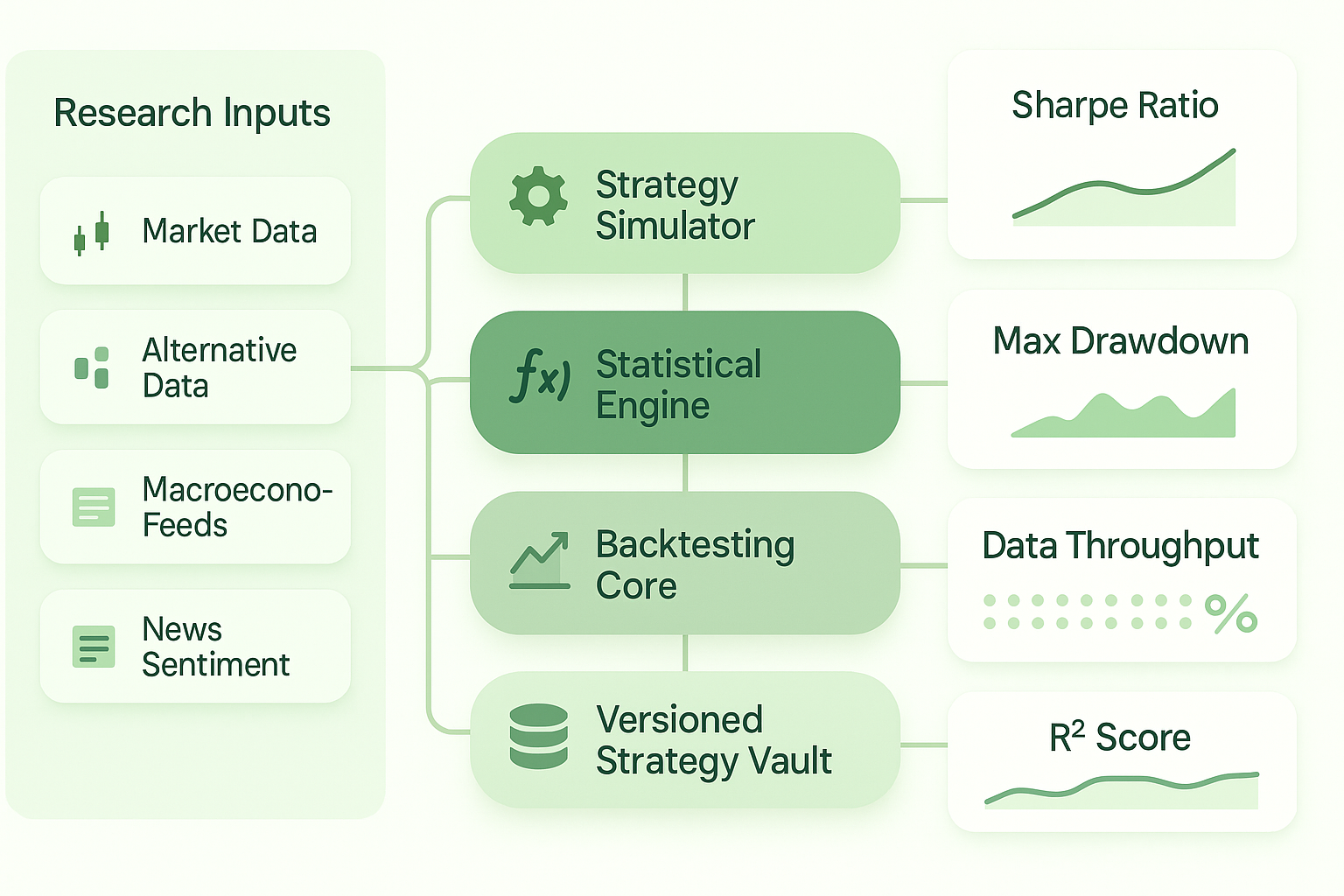

Core Research & Data Services

Data Engineering

High-performance data pipelines and real-time market data processing systems.

Statistical Analysis

Advanced statistical models and quantitative research frameworks.

Backtesting Systems

Comprehensive backtesting frameworks with realistic market simulation.

Data Engineering & Infrastructure

High-performance data pipelines, real-time market data processing, and scalable storage solutions for quantitative research.

Statistical Arbitrage

Advanced statistical models, cointegration analysis, and mean reversion strategies across multiple asset classes.

Backtesting Frameworks

Custom backtesting engines with realistic cost simulation, slippage modeling, and performance analytics.

Research Infrastructure

Comprehensive research environment with data access, analysis tools, and collaboration features.

Market Microstructure

Advanced analysis of order book dynamics, liquidity patterns, and market impact modeling.

Explore More Solutions

Data Engineering & ETL

- Automated ETL pipelines for real-time and batch data processing

- Data validation, cleansing, and transformation for high-quality analytics

- Scalable architecture for big data and streaming analytics

Research Infrastructure

- Unified research environment for data access, analysis, and collaboration

- Integrated tools for version control, reproducibility, and documentation

- Collaboration features for research teams and institutional workflows

Proven Track Record in

Capital Markets

Our systems power some of the most sophisticated trading operations globally

0ms

Average order latency achieved through our optimized execution engine and co-located infrastructure.

0M+

Monthly trading volume (USD) processed through our algorithmic trading systems.

0%

System reliability across all production environments, with 24/7 monitoring and support.